Got Credit / CC

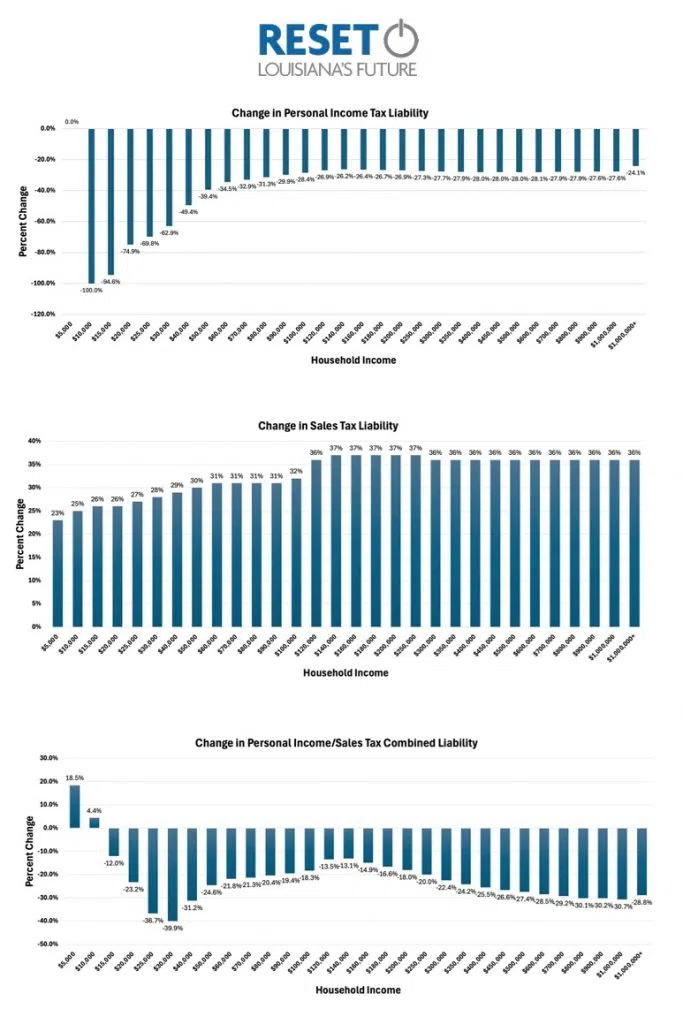

What impact will potential changes to sales taxes and personal income taxes have on taxpayers?

RESET Louisiana did a comprehensive study on that issue as lawmakers get set to debate Governor Landry’s tax reform proposal in a special session next month.

The organization hired economist and fiscal expert Greg Albrecht to conduct an independent analysis of the proposals and determine how they would impact taxpayers.

“Just about everyone’s going to get (an income tax) cut, and the vast majority of people will see fairly large cuts,” says Steven Procopio, president of the Public Affairs Research Council of Louisiana (PAR), of Albrecht’s findings. “Both the income tax, which wasn’t too surprising because of the large standard deduction even though it’s moving to a flat tax, made the income tax slightly more progressive. But even the sales tax relative to the current system was slightly less regressive.”

Which means a vast majority of Louisiana citizens will see a tax cut, almost all-in double-digit percentages. But the plan could also leave the state with fewer dollars to spend on education and other state services.

However, Procopio says the difference in tax burden changes is not that much different between income levels.

Source: RESET Louisiana

“But what it isn’t is a massive increase in regressivity, which is I think a lot of people had a lot of concerns over. PAR had a lot of concerns with it as well,” says Procopio. “So this report gives us a lot of comfort.”

Procopio says in the final analysis, nearly everyone will see their income taxes go down, but they will pay more in sales taxes.

“In the individual income tax, that has a lot to do with the increase in the standard deduction,” Procopio says. “(That’s) what was really driving that train. And on the sales tax side, it has to do with the fact that a lot of services that are going to be added tend to be either on the business side or tend to be used more by wealthier individuals.”

In its statement, RESET Louisiana stated, “RESET supports the broad concepts of the governor’s tax reform plan to simplify and modernize Louisiana’s uncompetitive tax system, but we also believe an independent review of what those changes mean for taxpayers is key to helping legislators and the public understand the ideas and scrutinize them.”

Lawmakers will convene in a special session next month to consider the sweeping proposals.

Comments