Denham Springs Representative Roger Wilder has decided not to move forward with a bill that would dramatically increase the tax rate for online sports betting, from 15% to 51%. Wilder filed the bill to boost state revenue by an estimated $150 million dollars a year to help offset legislation to reduce income tax rates for both individuals and corporations. Pineville Representative Mike Johnson supported the higher tax on sports wagering…

“But you wouldn’t believe how man people have come in, and are going through a divorce. Who’s children didn’t get Christmas because daddy bet all the money, either with a bookie or online betting, and in some cases Grandma and Grandpa are having to take care of the kids.”

Other proponents, like Louisiana Progress Executive Director Peter Robins-Brown says there is clear evidence of an increase of domestic violence as a result of the recent increase in online sports betting…

“When you create a situation or environment where families are going to be less stable, and people are going to feel horrible and stressed because of bad decisions, but these apps are incentivizing and making it easier.”

Louisiana Casino Association director Wade Duty warns the higher tax could discourage online betting platforms, potentially pushing customers to illegal options and impacting brick-and-mortar casinos, which partnered with online sportsbooks.

“Modifications to that tax rate have implications in many direction. Brick-and-mortar, existing revenue, future revenue. You can not expect a business to absorb a 340% tax increase and say business as usual.”

Caesars New Orleans General Manager Samir Mowad says the tax increase is being done in bad faith with expectations being set for when casinos initially invested in Louisiana…

“It just makes it a difficult environment to operate in, and less than a couple of years later you’re now looking at having that anywhere from doubled to more than triple.”

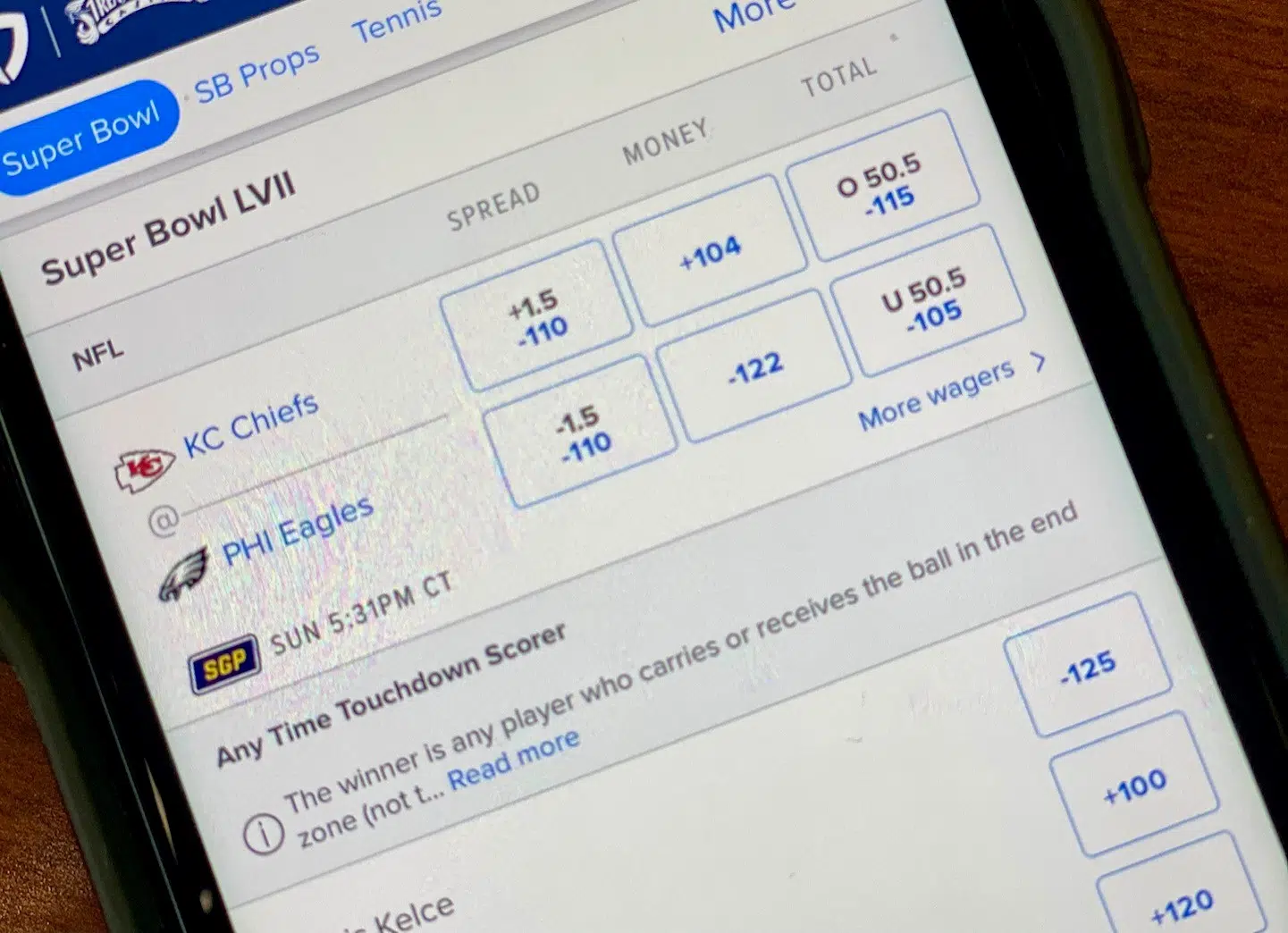

Online sports betting, legalized in 2021, is now a major revenue source in Louisiana.

Comments