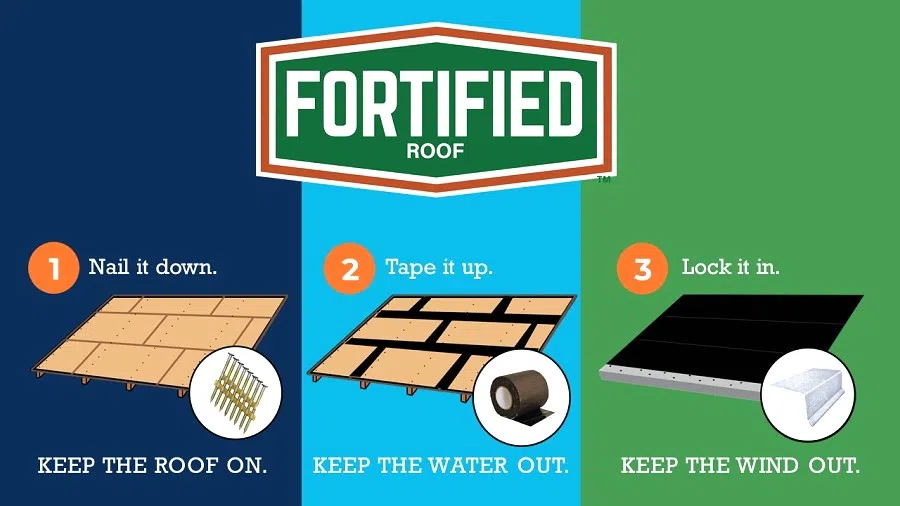

The Senate Revenue and Fiscal Affairs Committee approves legislation that would result in homeowners receiving an individual income tax credit of up to $10,000 dollars, if they voluntarily pay to install a fortified roof on their home. River Ridge Senator Kirk Talbot is the author of the legislation.

“If you have the means to front the money up front to get the roof, go ahead and get it and we’ll give you a tax credit that you can roll over for three years,” Talbot said.

Talbot says a fortified roof can reduce storm damage in a high wind event and that means fewer claims for insurance companies.

“This is the long-term solution for our homeowners’ crisis in the Louisiana because we’re always going to have storms. We’re always going to have that risk, and insurance companies know that,” Talbot said.

Talbot says the Louisiana Legislative Auditor’s Office recently found that homeowners who had a fortified roof installed saw a decline in their insurance premiums.

” They looked at all the people that have gotten roofs. I mean, the whole fortified roof program is barely two years old. I mean, barely two years old. And we’re already seeing a 22% on average reduction in premium,” Talbot said.

The measure heads to the Senate Finance Committee, because the proposal will lower state revenues.

Comments